Private Equity

Specializing in Clean Tech Companies

Acquisition Criteria

Our acquisition criteria align with that of our funding investors. Modeling our research, diligence and operational contribution along the acquisition criteria of our partners allows GLP to originate investments efficiently and at lower multiples. As industry experts we develop a thesis to present a viable financial, operational and ideological target companies that uncover off the beaten track possibilities.

Equity Strategy

- Enterprise Value <$100 M

- Value Added Services

- Low Leverage to Debt Ratio

Size Characteristics

- Revenue 15 to 200 million

- EBITDA 2 to 40 million

- Enterprise value under 100 million

Industry Focus

- Business Services

- Cleantech

- Solar

- Renewable Energy

- Technology

Transaction Strategy

- Control Preference

- Management Buyouts

- Shareholder Liquidity

- Spinoffs

- Restructuring & Turnarounds

Investors

Our firm helps Private Equity Groups and Strategic Acquirers find quality companies to acquire for their portfolio. Using an established search process, we help uncover hidden businesses that your firm would not ordinarily have an opportunity to find.

We provide high-quality investment opportunities for private capital investors at the lower end of the middle market. We work exclusively on the buy side for a select number of private equity investors and corporate clients to source and originate investment opportunities that fit their criteria on a generalist, opportunistic, and specific search basis. We source opportunities to acquire or invest in companies with revenues between $10 and $200 million.

By representing a select few clients, each with unique investment criteria, we create a sense of exclusivity and opportunity tailored to each client’s specific needs.

Our experienced firm can execute your business development plan for a fraction of the cost of a full-time originator. As deals are closed, the cost is recovered in the closing fees, making our services a cost-effective investment. We start by developing a sourcing strategy that aligns with your investment criteria and proceeds to acquire through traditional and non-traditional sources, analyzing the Teasers and CIMs. Our expertise allows us to evaluate opportunities, build models, determine valuation parameters, and more, all to deliver results.

Special business development projects can now get your firm’s attention. Internal resources combined with our deployable abilities allow you to dive deep into strategic acquisitions that were beyond your scope previously.

Business Owners

GLP helps business owners migrate the waters through private equity to total valuation. Some businesses are ready to transition from founder/owner-managed to private equity-controlled in one easy step. Others need the help of a firm that has a team of professionals that understand the triangular relationship between operations, finance and their ideological vision on what has made them successful. At Green Lane Partners we have the ability to work with you through the balancing of the three angles of the triangle until you have the greatest value to your market of acquires and then find the capital source to become your partners.

POrtfolio

Green Lane PARTNER’S portfolio of companies acquired or actively engaged in the transaction.

Sunrise Solar Solutions, LLC

a full service renewable energy company. Serving residential clients in the Hudson Valley New York area and commercial clients in the Northeast.

Oakwood Solar Farm

a solar farm that was built on top of land adjacent to a cemetery.

Yorktown Self Storage Solar rooftop

Acquired lease on storage facility to develop, build and put into operation a Community solar farm.

South Presbyterian Church SOlar Rooftop

Acquired lease on Church facility to develop, build, and put into operation a solar farm to benefit the church which allows not-for-profits to take advantage of specific tax benefits.

Rye Presbyterian CHurch Rooftop

Acquired lease on Church facility to develop, build, and put into operation a solar farm to benefit the church which allows not-for-profits to take advantage of specific tax benefits.

Pleasantville Presbyterian Church rooftop Solar

Acquired lease on Church facility to develop, build, and put into operation a solar farm to benefit the church which allows not-for-profits to take advantage of specific tax benefits.

Irvington Presbyterian Church Rooftop Solar

Acquired lease on Church facility to develop, build, and put into operation a solar farm to benefit the church which allows not-for-profits to take advantage of specific tax benefits.

Yorktown Presbyterian Church Rooftop Solar

Acquired lease on Church facility to develop, build, and put into operation a solar farm to benefit the church which allows not-for-profits to take advantage of specific tax benefits.

Temple Israel of northern westchester Rooftop solar

Acquired lease on Temple facility to develop, build, AND PUT INTO OPERATION A SOLAR FARM BENEFIT THE TEMPLE, allowing not-for-profits to take advantage of tax benefits not afforded to them.

Who We Are

Green Lane Partners

GLP addresses the needs as an independent sponsor delivering high-quality buy-side acquisition opportunities. We align the investment thesis of a select group of private equity investors with the innovative and non-traditional deal flow that fits on a financial, operational and ideological basis.

Rand M. MANASSE

Managing Partner

- 15+ years in Clean Tech

- NYU Stern School of Business – Finance major

- Inducted into Who’s Who in America

- Recognized as a leader in operational excellence

- Recognized leader in the renewable energy marketplace

Articles

by Green Lane Partners authored by Rand Manasse

-

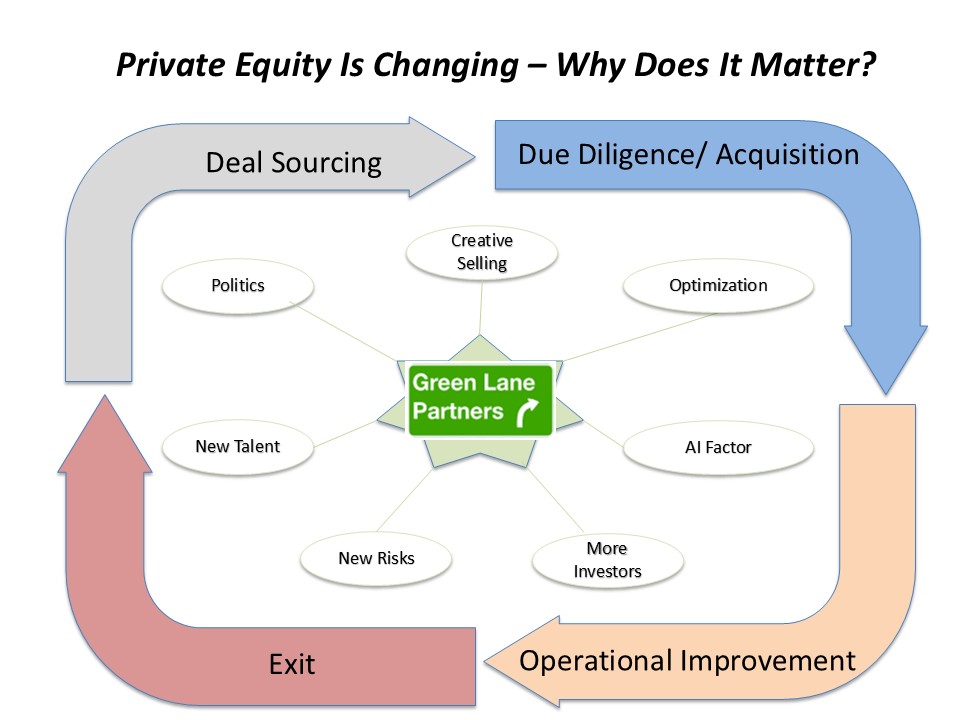

how private equity is changing – and why it matters

How Private Equity Is Changing — And Why It Matters Private equity (PE) was mostly about buying companies, making them more profitable, and selling them for a gain. These days, it’s getting a serious makeover. The biggest firms are becoming more like “all-in-one” financial problem-solvers, blending different types of investments, using new tech, and finding…

-

Leveraging Artificial Intelligence for Smarter Cleantech Investments and Risk Management

In an era of financial uncertainty, small to medium-sized enterprises (SMEs) increasingly seek sustainable growth opportunities, none more promising than cleantech. Yet, cleantech investments can be high-risk, long-term, and capital-intensive, which are difficult hurdles for SME’s to overcome, leaving them in a position of do or die. By leveraging AI, SMEs can analyze vast datasets…

-

Managing a Company’s Board Risk Committee: Navigating Uncertainty with Precision

In an era defined by rapid technological advancements, global interconnectedness, and unprecedented challenges, companies must navigate a labyrinth of risks to safeguard their operations and reputation. Central to this effort is the Board Risk Committee, a crucial oversight body that plays a pivotal role in identifying, assessing, and mitigating risks. Effective management of this committee…

-

Ethical Business Practices: Balancing Profit and Integrity

As a Fraud Examiner, I value corporate risk management equally with corporate values, strategies, and operations. Managing corporate risk is not just the business and operational responsibility of a company’s management team—it is a governance and strategic issue that is squarely within the board’s oversight responsibility. Companies that balance all three will succeed with increased…

-

The Future of CleanTech: Strategic Investments for a Sustainable Tomorrow

by Rand Manasse In this sector, investors can ensure that their resources contribute to sustainable innovations by carefully evaluating both the environmental impact and financial viability. This approach maximizes returns and supports the global transition to cleaner energy solutions, paving the way for future advancements with a financially stable, sustainable contributor. By investing in innovative…

-

What Do Fire Flies and Social Media have in Common?

By Rand Manasse When you were young did you ever catch a fire fly and wonder … “What if I could catch hundreds, or thousands, or even millions of fireflies and put them in a jar? Would they light up my room or even the whole city at night?” Developing the right combination of social…

-

-

Is Your Business Socially Aware?

by Rand Manasse This is an article about your business’s ability to be socially aware. The question might be, “Why does a business need to be socially aware?” And what does that mean? Does it mean that your business needs to meet other businesses? Do I need to get my business an account on Match.com? …

-

Will It Ever Happen? Just ask Tiger Woods or James Bond Stockdale.

by Rand Mark Manasse Will It Ever Happen? Just ask Tiger Woods or James Bond Stockdale. Are you at the point where you’re wondering if things will ever happen? It’s common for business owners, founders, CEOs and executives to struggle with this thought at some point. Most businesses go through struggle on their way to…

-

What Is Big, Hairy and Audacious … Is it Your Goals? It should be!

By Rand Manasse Big Hairy Audacious Goals are called BHAG’s (pronounced BeeHaagh). Perhaps you’ve heard the term before. It comes from the book Built To Last, written by Jim Collins and Jerry Porras. In their research, Collins and Porras found that companies that were built to last (and later ones that went from Good to Great)…